Hello, future homeowners! In my previous article, we explored the importance of preparing for your financial readiness before embarking on the home-buying journey. The next step is to reach out to your Mortgage Loan Originator and submit your Mortgage Loan Application.

In this article, I’ll provide a concise overview of what to expect and what information you’ll need to complete the Mortgage Application.

What’s a Mortgage Application?

As the name implies, the Mortgage Application allows you to apply for a loan to finance your home purchase, making the process straightforward and accessible.

Why Does the Mortgage Application Appear So Complex?

Following the 2008 mortgage reform, a new framework of laws, rules, and regulations was established. One significant change is how mortgage applicants present their information to secure financing for purchasing residential properties. That led to the creation of a Mortgage Loan Application.

How long does it take to fill out a Mortgage Application?

It really depends on how prepared you are. In this article, I’ll walk you through what to expect so you can get ready in advance. If you have all the necessary info on hand, filling out the mortgage application should take at most 20 minutes.

What Information Must You Provide in a Mortgage Application?

To apply for a mortgage loan, you must provide the lender with personal financial details and information about the property you wish to finance. This is done by completing the Mortgage Application, which consists of a series of questions that must be answered in full to move forward with the approval process for mortgage financing.

The Mortgage Loan Application Information Include:

An application consists of the submission of the following six pieces of information:

1. Property Address (in case of pre-approval it’s a geographical area where you plan to buy a home)

2. Estimated property value

3. Borrower Information

4. Credit Report

5. Income

6. Loan Amount

What documents are required when submitting a Mortgage Loan Application?

A fully completed mortgage loan application leads to the issuance of a Loan Estimate. However, it’s important to remember that this is merely an estimate. The Loan Estimate is meant to give you a general idea of your financial eligibility for obtaining a home loan. Thus, the more documents you submit, your loan estimate will be more accurate. If you truly want to understand your chances of securing the loan, it’s crucial to approach the mortgage application process seriously and provide as much relevant information as possible.

Please Note! If you decide to proceed with obtaining the loan, you’ll need to provide a specific set of documents. Therefore, it’s wise to prepare these documents early in the process.

Essential Documents Required For Initial Mortgage Application

Please prepare the following documents:

– Tax returns from the last two years.

– Pay stubs, W-2s, 1099 forms, or any other documentation verifying your income.

– Profit and loss statements, along with details of your bank and investment accounts and any additional evidence supporting your reported income.

– If you receive alimony, child support, disability benefits, unemployment, VA compensation, or any other forms of income, be ready to provide benefit statement letters or similar supporting documents.

– A government-issued identification

Depending on your unique situation, You may discover that additional documents will be required later in the process, so it’s important to stay prepared!

How to Submit Your Documents to the Lender?

These days, everything’s digital! Most documents are sent via email or uploaded to your mortgage portal. Because of this, it’s best to have everything in PDF format, though JPEG or PNG files can work, too.

If you need help converting your documents to digital format, just let me know, I’m happy to help!

What happens if you don’t have the needed documents on hand?

This informative article is here to guide you on what to expect! If you’re missing any documents, don’t hesitate to reach out to your lender for advice.

Remember, the Mortgage Application is just the beginning of your journey – being well-prepared will make the process faster and smoother.

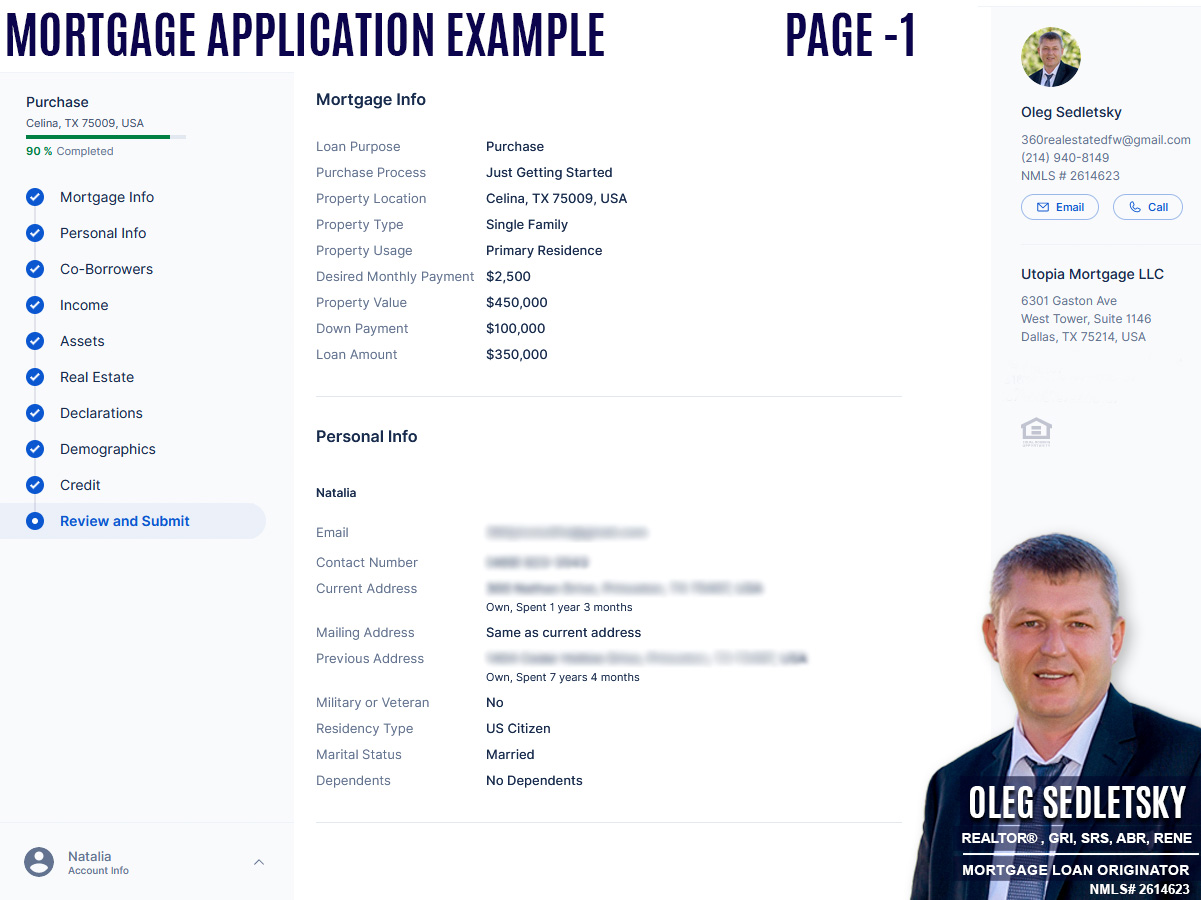

Below are the specific questions you will encounter in the Mortgage Loan Application.

Take your time to carefully review the questions in the Mortgage Application. Before clicking the “Apply For A Home Loan” button, gather the necessary information to complete the application quickly and efficiently!

Identify the Loan Purpose: Purchase or Refinance

Where are you in the purchase process (Just getting started, Making Offers, Found a house, under contract)

Where are you looking to purchase (Zip or City)

How will you be using this property (Primary Residence, Investment, Second Home)

What Type of property are you seeking

What is a comfortable monthly housing payment

Are you currently working with a real estate agent?

What is the approximate price of the property you are looking at

How much do you have for a down payment?

Down payment sources and amount

Where do you live currently ( Do you own this property or rent? How long did you live there)

What is your previous address (How long did you live there? Please provide a minimum of two years of history.)

Are you currently active in the military or a veteran?

What is your residency type (US Citizen, Permanent Resident Alien, Non Permanent Resident Alien)

What is your marital status?

Do you have any dependents?

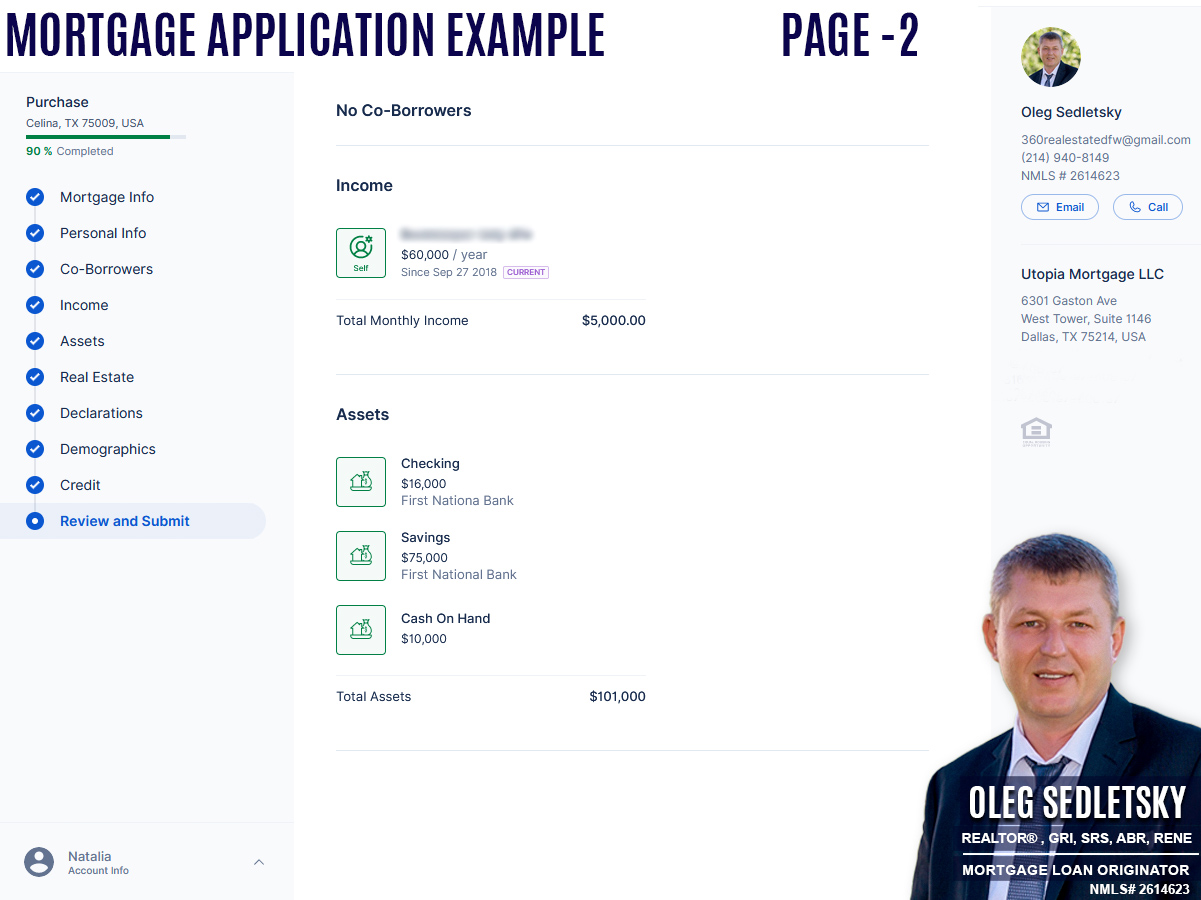

Employment Info (Please provide the following information: income, job title, start and end dates, office address and phone number, duration in the position, and a history covering at least 2 years.)

Asset Details (bank accounts, stock Options, Cash on Hand, etc.)

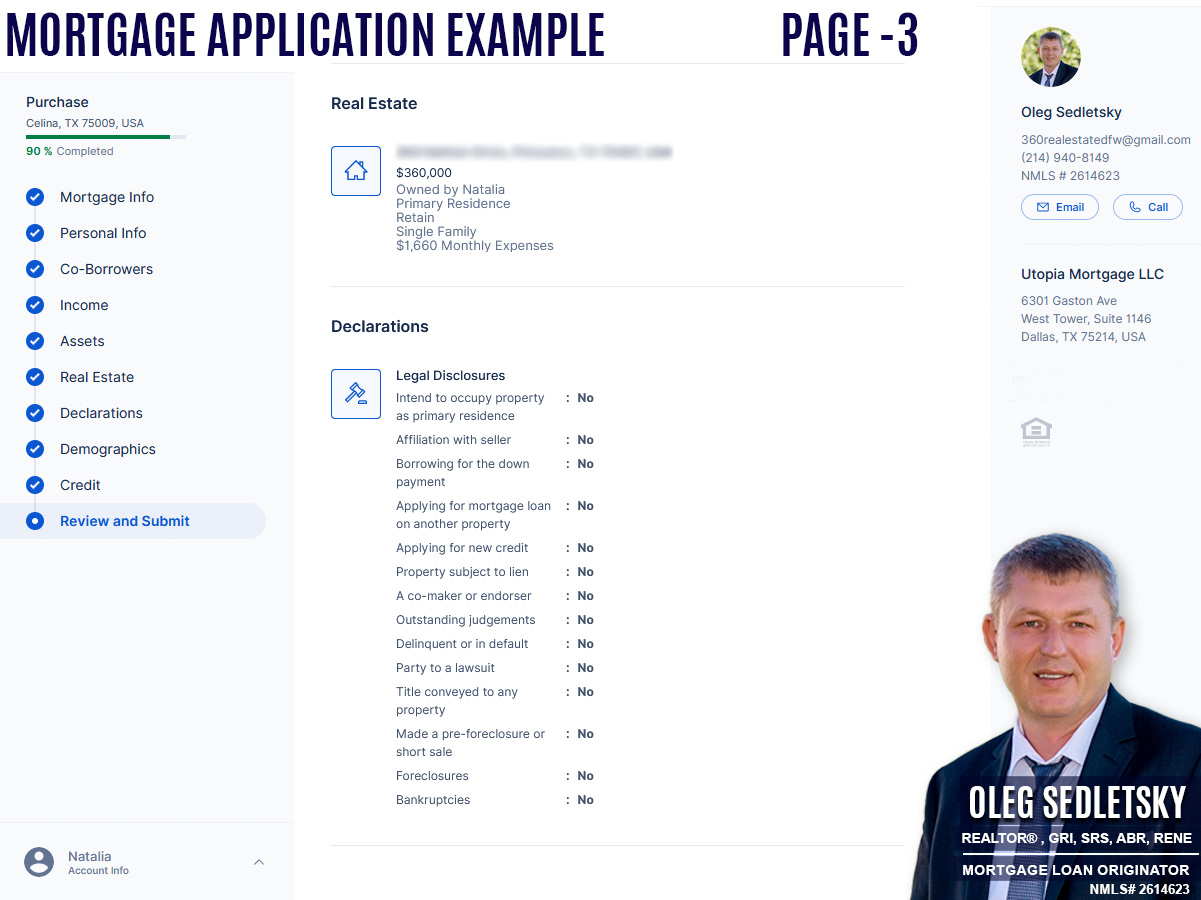

Do you own any real estate?

Declarations

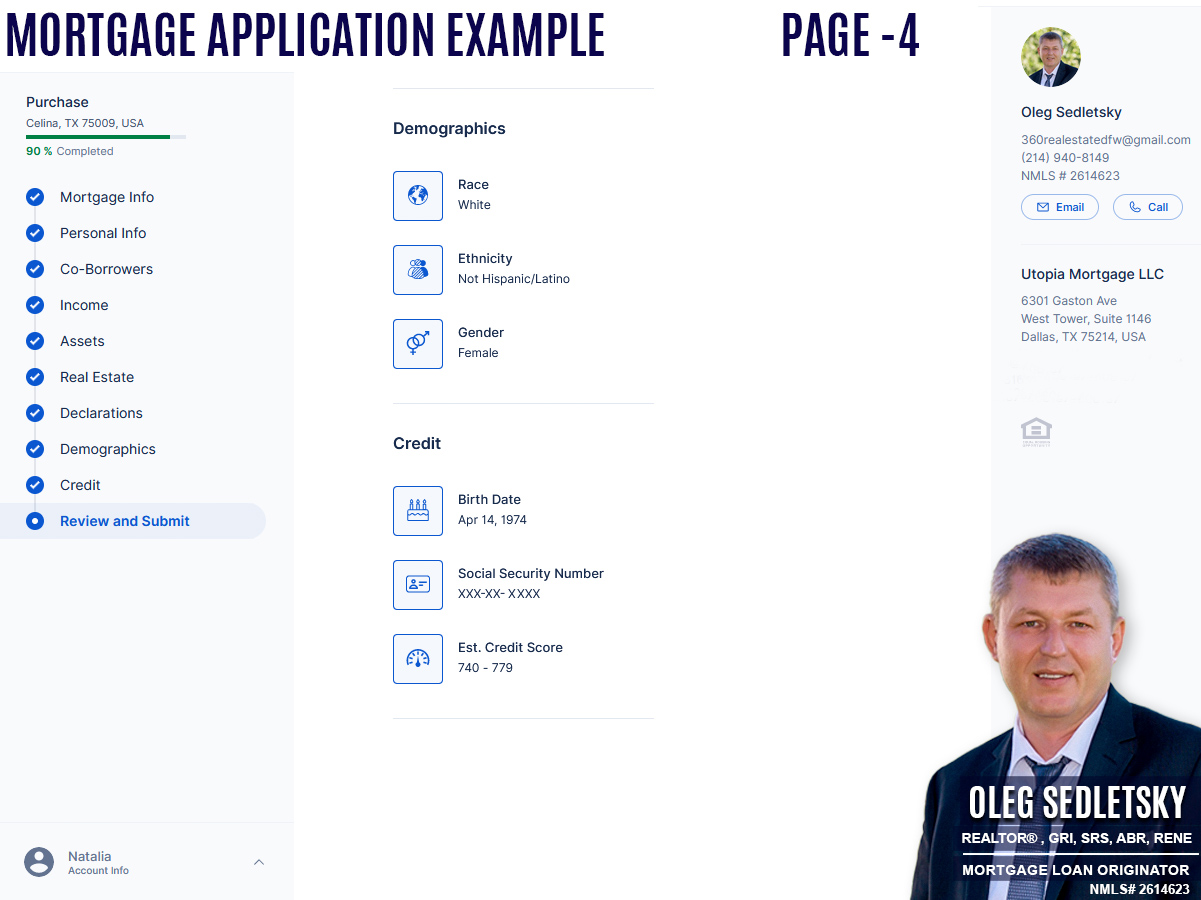

Demographics

DOB, SS#

What is your credit score?

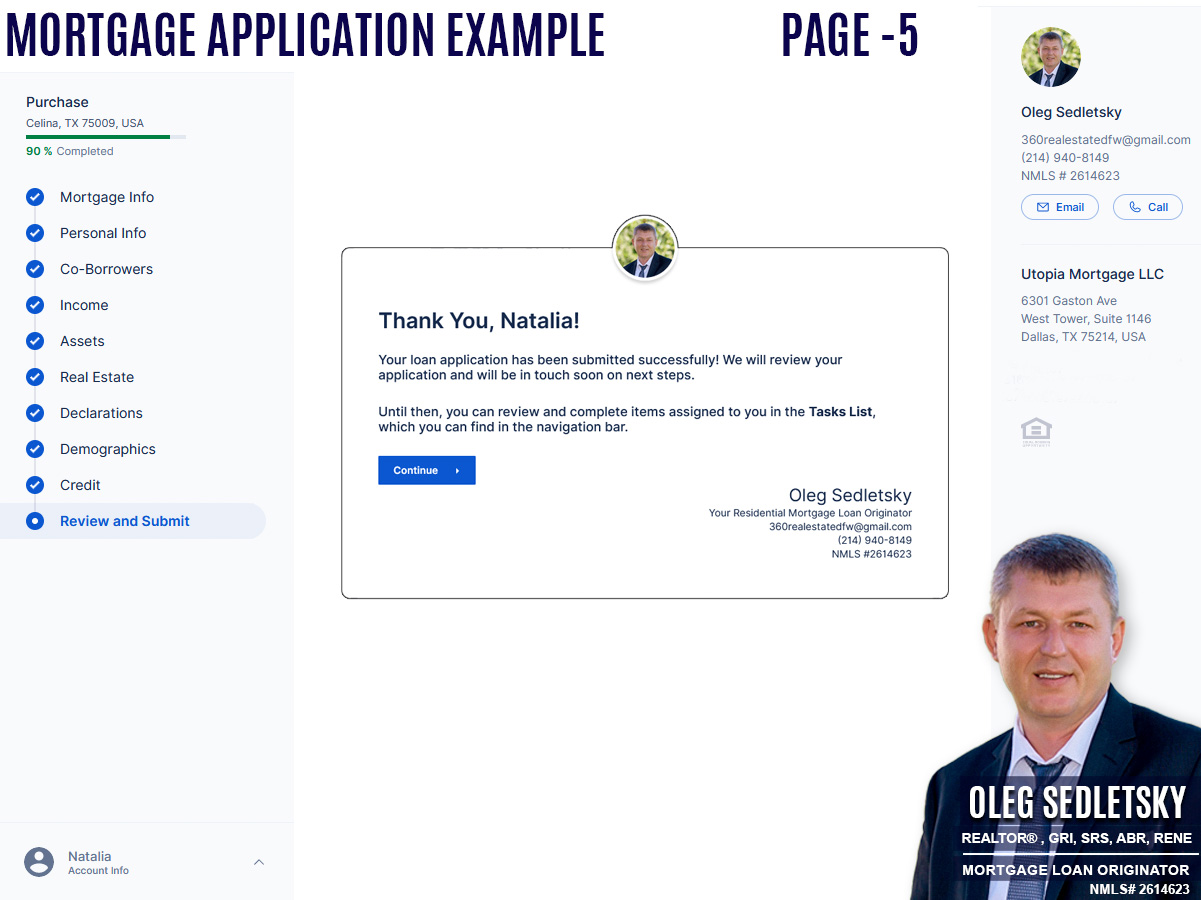

Here’s a preview of how the completed application appears in your portal.

Discover the FannieMae Mortgage Application! This powerful tool serves as a comprehensive guide for all mortgage loan originators, streamlining the application process and setting the standard for excellence in the industry.

Apply For A Mortgage Today!

Applying for a mortgage is simple and convenient. I offer both an online application option and the ability to apply over the phone.

APPLY FOR YOUR HOME LOAN HERE – Enjoy a secure and easy online mortgage application process.

Call 214-940-8149 now to apply by phone.

Just fill out the Mortgage Application, and you’ll be one step closer to unlocking your dream home. Once I receive your information, I’ll assess your current situation and determine the home price you’re qualified for. Together, we’ll explore tailored recommendations on mortgage products and identify any improvement areas to pave your path to success!