The 2013 real estate market in Princeton, Texas experienced substantial growth and dynamism, reflecting both increased demand and a diverse inventory. This analysis examines 179 single-family home sales, highlighting pricing, property features, market efficiency, and standout transactions that shaped the year.

Key Takeaways and Trends from Princeton’s 2013 Real Estate Market

- Pricing Range:

The market displayed greater price variety, ranging from $18,674 at the entry level to $675,000 for upscale luxury homes. Average and median prices increased markedly, affirming demand strength. - Market Efficiency:

Homes sold quicker, with DOM dropping by 26.1% to an average of 51 days. High close-to-list price ratios further underscore a hot market. - Unique Outliers:

The $675,000 luxury home sale with over 32 acres, pool and premium amenities highlighted buyer confidence in Princeton’s high-end property sector. - Mortgage Rates Impact:

Although mortgage rates edged higher to 4.16%, the sustained property turnover and pricing growth suggest this had minimal impact on market activity.

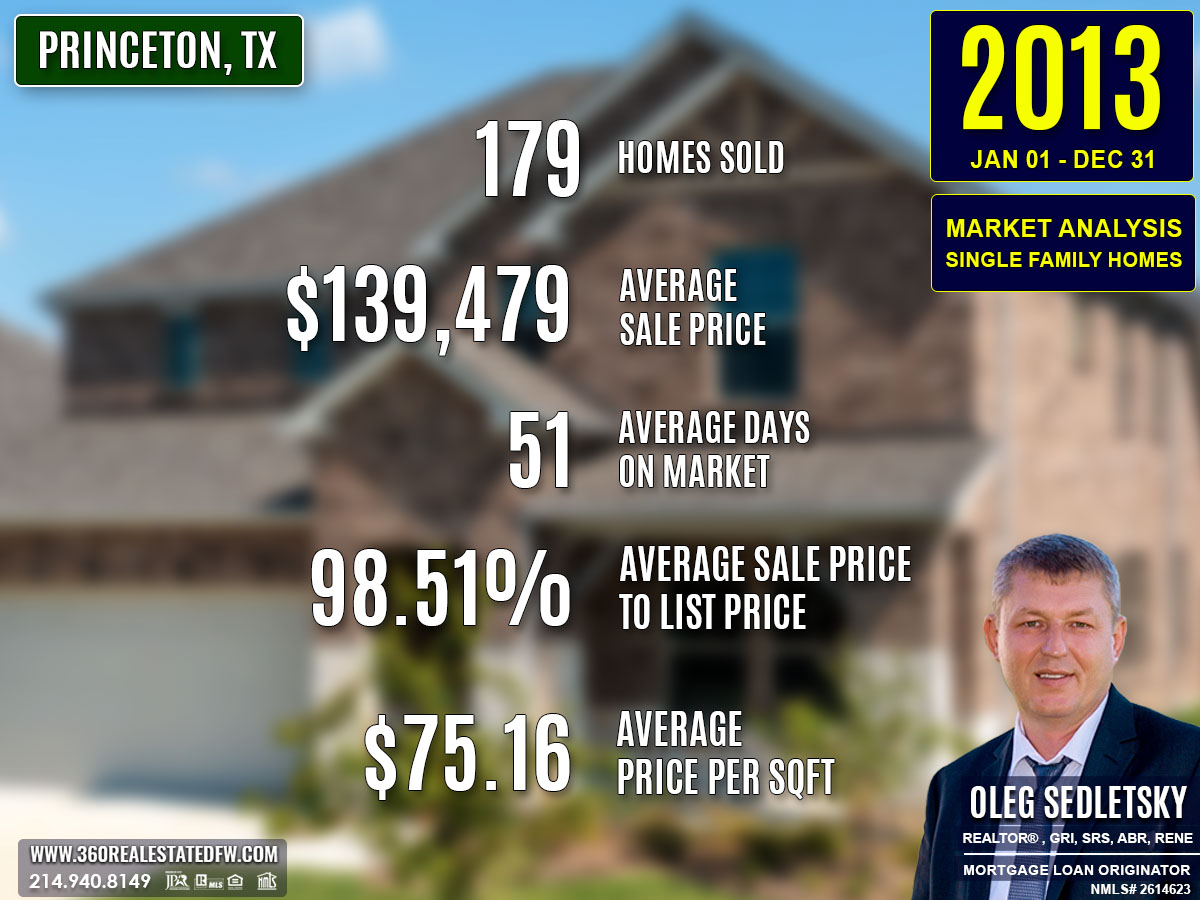

Total Homes Closed

- Closed transactions: 179 homes sold, up 17.8% from 152 homes sold in 2012.

- New construction: 39 newly built homes sold, exceeding the 32 recorded in 2012.

- Homes with pools: Sales remained consistent with 7 homes with pools sold, matching the 2012 volume.

Property Pricing Insights

Pricing trends reflected stronger buyer demand and a wider market range throughout 2013:

- Minimum price: $18,674 (down from $21,000 in 2012).

- Maximum price: $675,000 (a sharp increase from $399,000 in 2012).

- Average price: $139,479, showing a 12.8% rise from $123,624 in 2012.

- Median price: $139,900, higher than 2012’s $122,500.

This noticeable increase in pricing indicates heightened buyer activity and willingness to invest in premium properties.

Property Size and Features

Home features in 2013 offered a balance of space and variety to meet buyer preferences:

- Bedrooms: Properties averaged 3 bedrooms, ranging from 2 to 5 bedrooms.

- Bathrooms: Most homes included 2 full bathrooms, with totals ranging from 1 to 5 bathrooms.

- Square footage: Sizes ranged between 832 sqft and 4,026 sqft, with an average of 1,834 sqft.

- Lot sizes: Average lot size slightly decreased to 0.729 acres, though properties ranged up to a significant 32.8 acres.

Market Dynamics

Key metrics reveal a faster and more competitive real estate market in 2013:

- Days on Market (DOM): Homes sold at an average of 51 days, down from 69 days in 2012.

- ClsPr/LstPr Ratio: The close-to-list price ratio improved to 98.51%, indicating minimal price reductions.

- ClsPr/OLP Ratio: Original listing price ratio increased to 97.29%, up from 92.33% in 2012.

- Average price per sqft: $75.16, reflecting a consistent rise from $63.61 in 2012.

These metrics highlight growing homebuyer competition and confidence in the market.

Insights into the Most Expensive Princeton, TX Property Sold in 2013

The priciest home sold in 2013 was a premium property offering both luxury and value. This site blended modern amenities with spacious acreage, selling for $675,000.

Key Metrics:

- Price: $675,000

- Beds/Baths: 5 bedrooms, 5 bathrooms (4 full, 1 half)

- Square Footage: 3,583 sqft

- Price per square foot: $188.39

- Lot Size: 32.829 acres (including a pool)

- Days on Market (DOM): 140 days

- ClsPr/LstPr Ratio: 96.43%

- ClsPr/OLP Ratio: 96.43%

- Year Built: 2000

This standout property showcased Princeton’s evolving luxury market, offering extensive land and premium features that justified its top-market valuation. Such sales signal growing interest in upscale investments.

Economic context

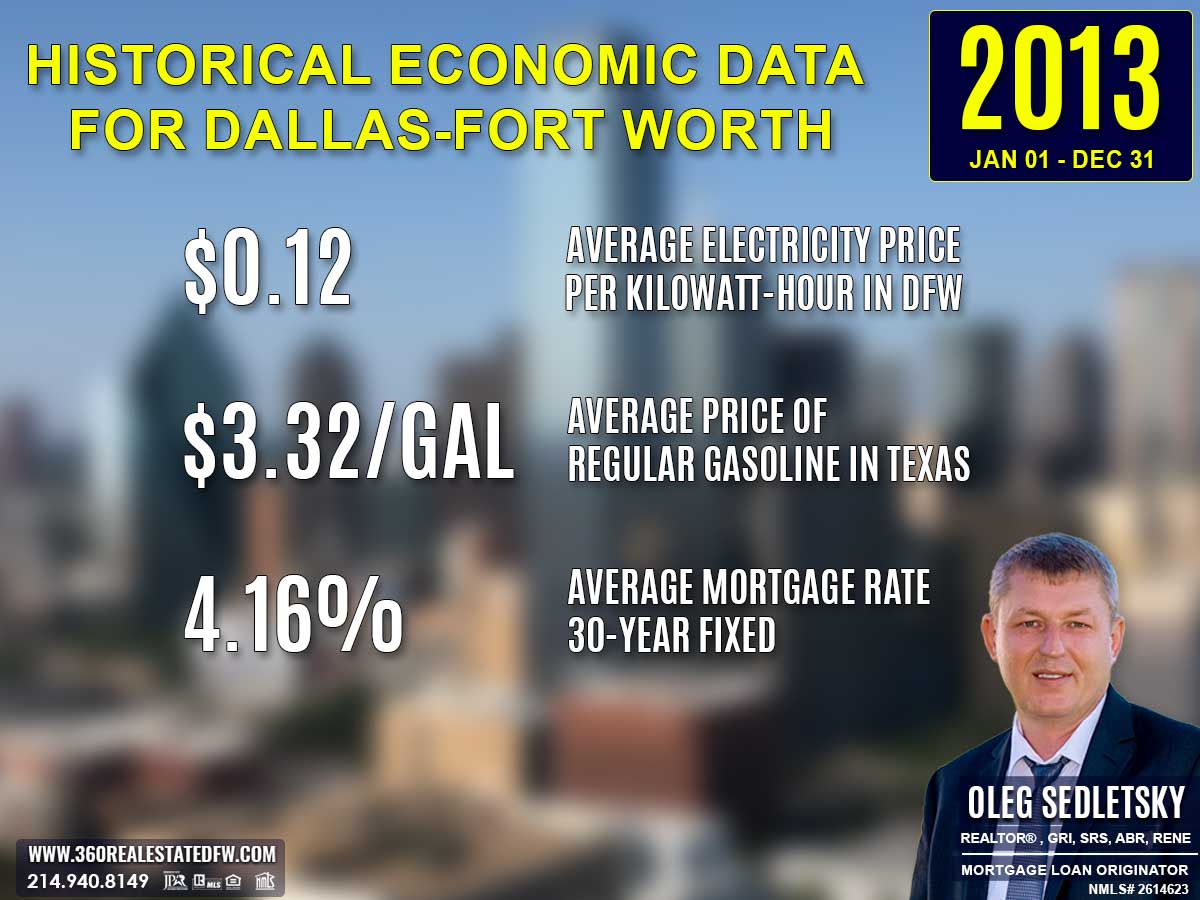

Average Electricity Costs in Dallas-Fort Worth in 2013

Electricity prices increased to $0.12 per kilowatt-hour in 2013, compared to $0.11 in 2012. This slight rise might have led consumers to reassess their energy usage and consider more energy-efficient homes. Real estate agents likely saw growing interest in properties with features like modern insulation or smart energy systems, which could offset rising utility expenses.

Average Price for Regular Gasoline in Texas in 2013

Gas prices decreased to $3.32 per gallon in 2013, down slightly from $3.42 in 2012. This minor drop helped ease transportation costs for homebuyers. With slightly lower fuel expenses, potential buyers may have been more open to properties in suburban areas, especially if housing prices were more competitive than in urban locations.

Average 30-Year Fixed Mortgage Rate in 2013

Mortgage rates inched up to 4.16% in 2013 from 3.88% in the prior year. While the increase wasn’t drastic, it may have nudged some homebuyers to act sooner rather than later to secure financing. Homebuyers are encouraged to work with local mortgage loan originators to ensure they understand their borrowing capabilities and can lock in competitive rates with ease.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2012 and 2013 Real Estate Markets in Princeton, Texas

Volume of Sales

Home sales increased significantly from 152 homes in 2012 to 179 homes in 2013, a 17.8% growth in market activity.

Pricing

- Minimum price: Dropped slightly from $21,000 in 2012 to $18,674 in 2013, reflecting wider accessibility.

- Maximum price: Jumped dramatically from $399,000 to $675,000, signaling greater demand for high-end properties.

- Average price: Rose from $123,624 in 2012 to $139,479 in 2013, an increase of approximately 12.8%.

- Median price: Increased from $122,500 to $139,900, highlighting a rise in typical property values.

Market Efficiency

- Days on Market (DOM): Dropped from 69 days to 51 days, indicating quicker sales and strong competition.

- ClsPr/LstPr Ratio: Improved from 96.95% to 98.51%, showing higher alignment between listed and final sale prices.

- ClsPr/OLP Ratio: Rose from 92.33% to 97.29%, reflecting reduced price cuts before closure.

Property Features

- Average square footage: Reduced from 1,958 sqft in 2012 to 1,834 sqft, hinting at a preference for slightly smaller living spaces.

- Lot size: Decreased from an average of 0.887 acres to 0.729 acres, though outliers like the 32.8-acre property pushed the upper limits.

- Homes with pools: Sales remained consistent, with 7 homes sold with pools in both years.

- New construction: Increased from 32 homes in 2012 to 39 homes in 2013, indicating growth in new housing developments.

Economic Context

- Mortgage rates: Rose from 3.88% in 2012 to 4.16% in 2013, slightly increasing borrowing costs.

- Gas prices: Decreased from $3.42 per gallon in 2012 to $3.32, potentially easing overall household expenses.

This comparison highlights how 2013 saw significant growth in property values, more efficient market activity, and greater demand for luxury real estate, despite minor increases in borrowing costs.

Summary of Real Estate Market Analysis for Princeton, TX in 2013

2013 real estate market in Princeton, TX exemplified positivity with an 17.8% sales volume increase and a significant rise in average property prices. Properties sold quickly as competition intensified, with homes spending 51 days on average on the market. Pricing trends showed a surge in high-end transactions, as evidenced by the $675,000 luxury home sale. Meanwhile, the typical home maintained its affordability with mid-range prices and modest sizes.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Oleg Sedletsky REALTOR® in Princeton, Texas. Call/Text 214.940.8149

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2003 to Present

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

2021-Present

Princeton, TX Real Estate Market Report 2021: Analysis and Trends

Princeton, TX Real Estate Market Report 2022: Analysis and Trends

Princeton, TX Real Estate Market Report 2023: Analysis and Trends

Princeton, TX Real Estate Market Report 2024: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.